News & Insights

WELCOME TO THE RECTANGLE

News & Insights

Explore our latest insights, market research, acquisitions, and project updates – all in one place. Subscribe to never miss an update.

Featured Whitepapers

2025 Review

Industrial Outdoor Storage

All of a Sudden, Income Matters

Featured Videos

The Return of Income

Tolleson Asset Overview

Small-and shallow-bay

Austin White, Senior Vice President of Investments, shares insights into the dynamics of small- and shallow-bay industrial assets—one of the most resilient and in-demand segments of the market.

Quarterly Updates

3Q25 update

2Q25 update

1Q25 update

This quarter, we’ve continued to refine our focus on small- and shallow-bay (SSB) industrial—and we’ve shared a deeper look at the strategy behind it. Inside this look back at our first quarter: The Case for SSB Industrial — our new whitepaper, asset spotlight: a high-quality small-bay property in Tolleson, AZ, and video insights from our team, including President John Comunale. Explore how we’re investing through the current cycle—and why we believe the fundamentals of SSB remain as strong as ever.

Market Spotlights

Dallas

Phoenix

Denver

Recent Projects & News

Leased

We’re excited to welcome RK Steel as a tenant after signing a 70,000 SF lease at a freestanding, single-tenant industrial building in Denver with a secure storage yard.

This transaction reflects continued demand for well-located, functional industrial space.

We’re looking forward to a strong partnership ahead.

Acquisition

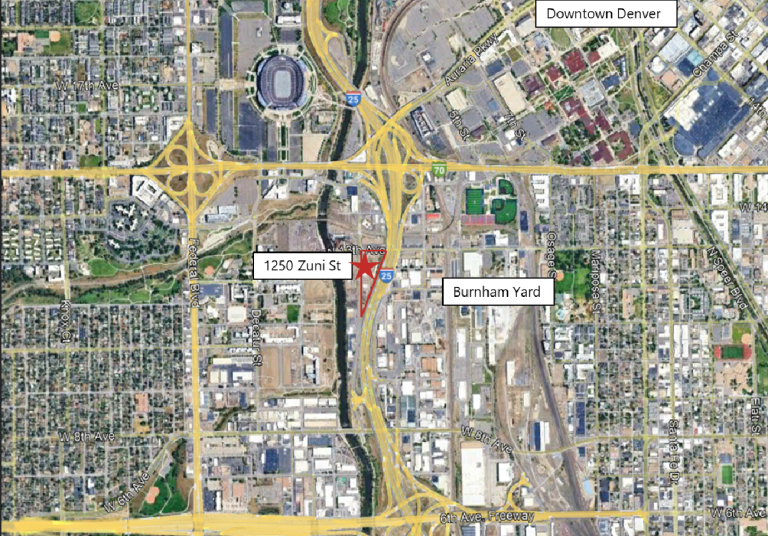

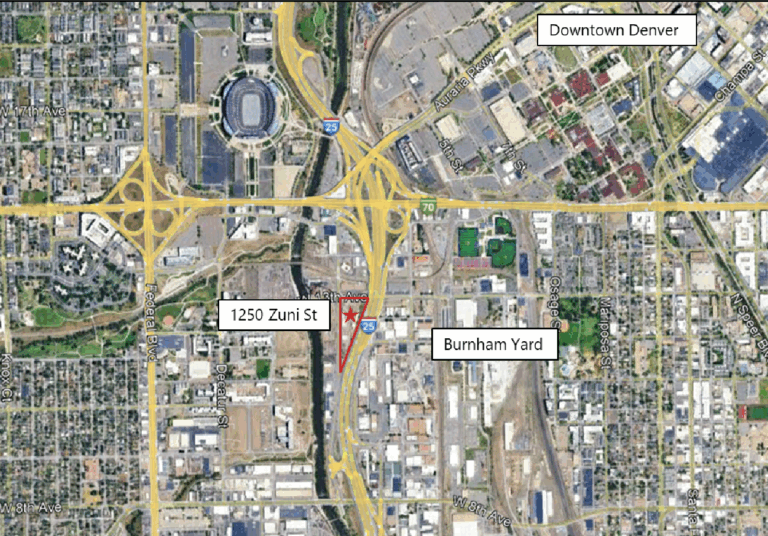

Rectangle Investment Management is excited to announce the acquisition of 1250 Zuni Street in Denver, CO — a 2.86-acre Industrial Outdoor Storage (IOS) site with direct I-25 frontage, located less than a mile from downtown Denver.

The property is 100% leased through 2032 to a credit tenant with below-market rents, providing long-term stability, dependable cash flow, and growth upside. Its central infill location, strong visibility, and connectivity to Denver’s core also create compelling future redevelopment optionality.

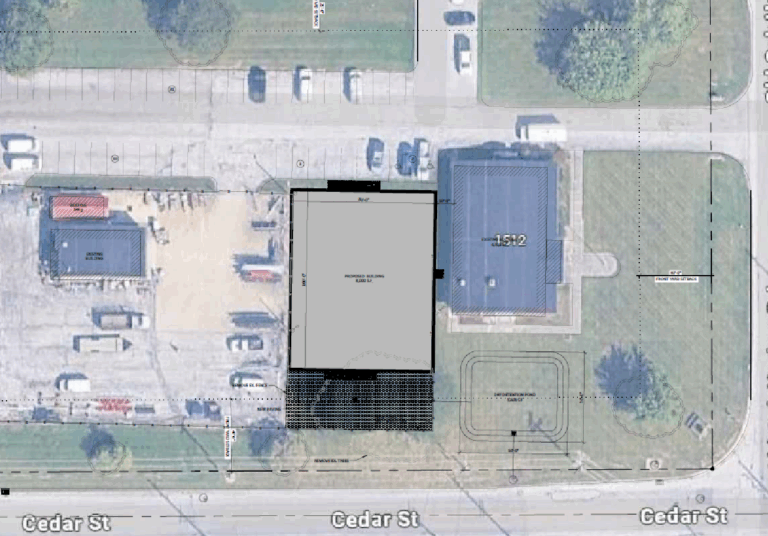

Build-to-suit

We’re adding a new 8,000 SF warehouse expansion to one of our existing IOS (Industrial Outdoor Storage) sites. This project is a true partnership—we’re working closely with an existing tenant to meet their growing operational needs, adding drive-through doors for increased functionality and flexibility. This project supports tenant growth, expands site capabilities, and enhances the long-term value of the asset.

We’re excited to help our tenant scale their business while unlocking the full potential of the site.

Acquisition

We closed on an off-market property for an existing tenant in our portfolio—marking our 12th building together across four states. This property is strategically located adjacent to the tenant’s current facility and will support the growth of one of their key divisions. The building features a 15,000 SF footprint and ½ acre of yard space—a perfect fit for their evolving operational needs.

At the core of our strategy is building long-term partnerships, and this deal is a great example of that in action.